Are gutters covered by home insurance?

Your standard homeowner’s insurance will cover your gutters because they are structural parts of your home.

However, there is really no assurance that your insurance company will cover your claim for rain gutters.

The “perils” against which your insurance provides coverage are detailed in your policy. Nothing can be done if the danger that caused the gutters to break is not addressed.

Options of Perils

There are two types of coverage available for home insurance: “identified perils” and “all risks.” In the case of damage due to one of the specified perils, such as fire or theft, coverage under a named-perils policy will kick in.

Except in cases where an exception applies, all-risks policies will pay for repairs to your gutters if they are damaged. Mortgage companies strongly recommend getting a policy that covers everything, as this is a requirement of their industry.

Limitations on Coverage for Gutters

If your gutters break because of the wind, something falling on them, vandalism, or a fire, all-risks coverage will usually pay for the damage.

All but the most comprehensive insurance won’t pay out for losses caused by earthquakes, floods, or war. Homeowners can, however, protect their investments by investing in separate flood insurance policies.

There are variations in the norms from one region to another. You might not be able to get wind coverage if you live near the Gulf Coast, where hurricanes are common. Rusting through gutter damage isn’t covered because it’s just normal wear and tear.

Gutter Maintenance: Why It’s So Crucial

Although gutter upkeep isn’t covered by insurance, it should still be prioritized.

If your gutters are blocked or broken, water can leak through your roof or pool in your basement, which can cause structural damage to your property.

Your insurance company may deny your claim if they determine that you haven’t taken care of the basics.

Even if the policy pays out, you’ll have to pay for any damages that are smaller than your deductible out of pocket. To save money, you should try to prevent water damage.

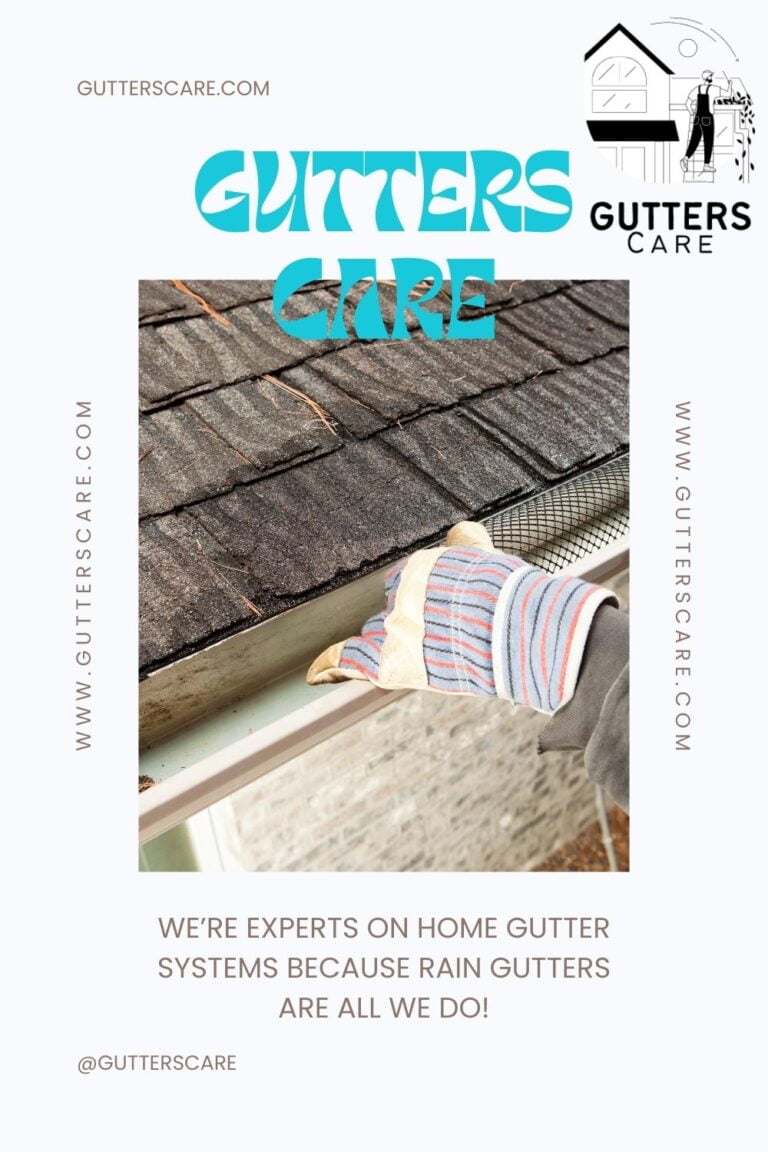

Cleaning your gutters on a regular basis is an important part of gutter maintenance.

Putting off this task increases the likelihood of decay, pests, and structural issues.

Look for damage that can be easily fixed while you’re cleaning the gutters. If you see any damage, even if it seems minor, like loose connections or pinholes, fix them immediately so they don’t grow into anything worse.

Snow and Ice Can Cause Gutter Damage

If ice and snow pile up in your gutters and cause damage, your homeowner’s insurance will likely pay to repair or replace them.

Snow or rain can only enter your home through the roof if the gutters are blocked by an ice dam. This kind of loss is paid for.

However, your insurer will expect you to take steps to lessen the harm as soon as you become aware of it.

Your insurance company may not cover all of the damage if you discover water leaking through your roof due to melting snow and you do not move the furniture out from under the leak.

Keep detailed records of what the storm did to your property, what you did to fix it, what you said to your insurance company, and any other costs you had to pay because of it.

Damaged rain gutters, now what?

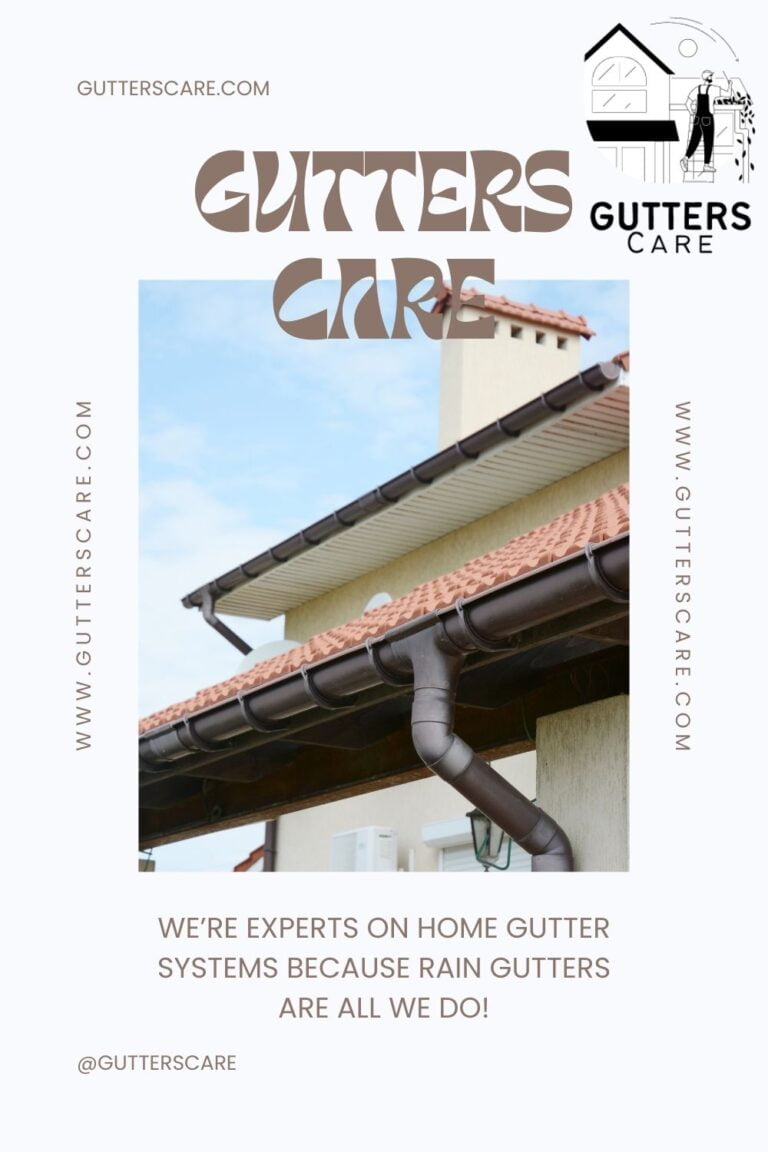

In order to keep the outside of your home in good condition, rain gutters must be installed. Rain gutters are an important part of a building because they keep water away from the foundation.

In the event that your rain gutters are damaged or beginning to pull away from your house’s exterior, you may have an issue.

Will my homeowner’s insurance policy pay for broken gutters?

If you’re wondering if you’ll be covered, the answer is probably. Read your policy carefully so you know what disasters you are protected against. A danger is a specific type of risk that homeowner’s insurance policies cover.

On a home insurance policy, risks and perils are used interchangeably. Most home insurance policies cover risks like fire, smoke, lightning, vandalism, theft, and damage from things falling on the house.

Events that could qualify rain gutters as an insured risk

It’s possible that certain events qualify rain gutters as an insured risk.

The arrangement is that if a tree falls on your property and damages your rain gutters, your homeowner’s insurance might pay to have them fixed.

In addition, if your rain gutters are damaged by an act of nature, such as ice, wind, or snow, your insurance may pay for the repairs.

If someone breaks into your home and damages your rain gutters, there is a good chance that your insurance will pay to fix them.

The Exclusions to Your Homeowners Policy for Rain Gutters

It’s unlikely that your insurance coverage will protect you if your rain gutters are in disrepair due to a lack of maintenance or simply because they’re past their prime.

When you own a home, it becomes your duty to take care of the upkeep. Maintaining them properly entails giving them a regular once-over for dirt and wear.

Keep in mind that if the claims adjuster determines that the damage was the result of your negligence in maintaining the property, your claim may be rejected.

Claims for water damage caused by, say, a cracked rain gutter could be refused if the owner had not kept the property in good repair.

Care for Your Rain Gutters Is Crucial

Include gutter cleaning in your normal schedule of home maintenance. Leaves, debris, and moss can clog the rain gutters and should be removed.

Be sure your gutters are secure and your downspouts are clean. Water can be diverted away from a house using splash blocks or pipework.

More Gutter Articles

- Ultimate Guide to the Best Rated Leaf Guards for Gutters

- Ultimate Guide to Installing Leaf Gutter Guards: Say Goodbye to Clogged Gutters!

- Safe Haven Gutters vs. DIY: Which Is the Best Shield for Your Home?

- Ultimate Guide to Essential Gutter Cleaning: Tips, Tools, and Techniques

- Dangers of Stagnant Water in Gutters: Causes, Effects, and Solutions

- How Grey Gutters on a White House Transform Your Home’s Exterior

- Ultimate Guide to Norandex Gutter Guards: The Solution to Your Home’s Gutter Problems

- LeafFilter Consumer Reports: Ultimate Guide to Gutter Protection

- Revolutionizing Your Home: Gutter Solutions and Home Improvements

- Definitive Guide to Seamless Gutter Installation: Tips, Costs, and Benefits

- Ultimate Guide to Gutter Services: Installation, Maintenance, and Repair

- Everything You Need to Know About Gutter Installation Services

- White House Black Gutters: Ultimate Guide to Maintenance and Style

- Everything You Need to Know About Gutter Contractors: Tips for Hiring the Best in Your Area

- Ultimate Guide to Choosing the Best Gutter Leaf Protection System

- Understanding the Cost for Gutters on a House: A Comprehensive Guide

- Leaves in the Gutter: Causes, Consequences, and Effective Solutions

- Choosing the Best Gutters for Your 4000 Sq. Ft. House: A Comprehensive Guide

- Ultimate Guide to Micro Mesh Gutter Guard Installation

- Guide to Understanding the Cost of New Gutters and Downpipes

- Enhance Your Home’s Aesthetics with Black Roof and Black Gutters on a Brick House

- Enhancing Your Homes Curb Appeal: Black Gutters on a Gray House

- Ultimate Guide to Residential Gutter Cleaning: Tips, Techniques, and Benefits

- The Gutter Man: Your Ultimate Guide to Gutter Maintenance and Repair

- Gutter Covers That Will Change Your Life (For the Better)

- Leaf Filters: Ultimate Guide to Buying and Installing Gutter Guards

- Downspout Extensions: Ultimate Guide to Protecting Your Home from Water Damage

- Down Spouts: How to Prevent Clogs, Leaks, and Rust

- LeafGuard Gutters: The Ultimate Gutter Protection System

- Home Depot Gutters: Ultimate Guide to Choosing, Installing & Maintaining Your Gutter System

- Gutter Downspouts: Ultimate Guide to Choose, Install, and Maintain Them

- Leaf Guards: The Ultimate Buyer’s Guide for 2023

- How to Choose the Best Gutter Guards for Your Home (and Avoid Costly Mistakes)

- How to Choose the Best Rain Gutters for Your Home: Step-by-Step Guide

- 3 Best Gutter Sealants to Prevent & Fix Leaks (2023)